Nature’s balance sheet: what is the role of accountants in tackling the nature crisis?

WHY DOES NATURE MATTER TO BUSINESS AND THE ECONOMY?

Nature provides us with clean air, water, food and a wealth of materials for free. Over half the world’s GDP, roughly US$44 trillion of global economic value generation, is moderately or highly dependent on nature.1 Yet, we are losing this essential asset at an alarming rate, with most of the loss having taken place within the last 50 years. Biodiversity loss and ecosystem collapse, along with natural resource crises, feature in the top four of the World Economic Forum’s list of the top ten economic risks for the next ten years.2

Awareness of the importance of nature loss is increasing among business, investors and regulators, although too little action is being taken. Every business ultimately relies on nature for resources, both in their own operations and supply chains, and for wellbeing of their employees and customers. An organization’s business model, for example, may be dependent on the flow of clean water, clean air, fertile soils or the regulation of hazards such as fires and floods. Often we only see this when those ecosystems become unbalanced, due to the unsustainable use of natural resources. For example, the over extraction of natural water sources can quickly cause manufacturing issues where water is a key resource eg food and beverage companies, or where it is used as a coolant in a plant. Unsustainable agricultural practices lead to soil degradation and reduced yields, and overuse of chemicals causes a decline in insects and birds which means crops are not being pollinated, resulting in costly interventions.

Nature loss is associated with significant financial and organizational risks. These stem from both nature-related physical risks, including the loss of services such as clean water filtration and climate regulation; and transition risks, including policy changes, market shifts and emerging liabilities.

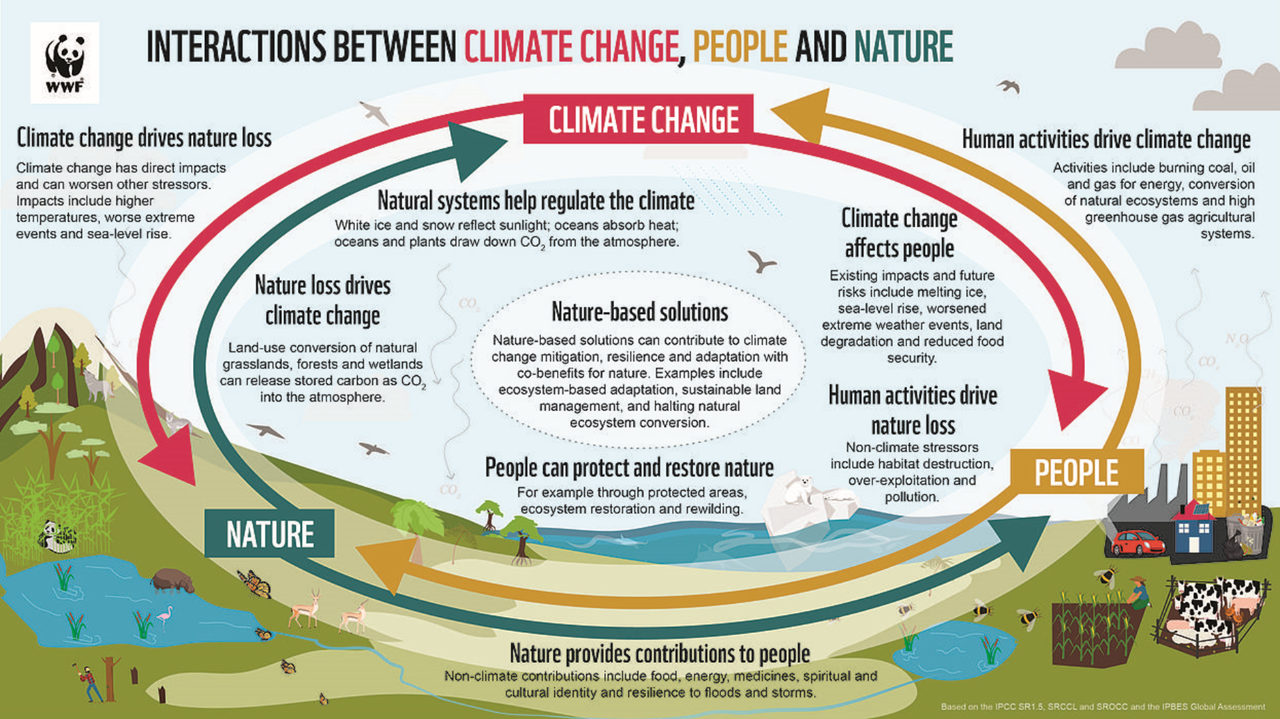

The A4S Finance Leaders Barometer 2024 revealed a worrying gap in understanding around the impact of biodiversity loss. While many organizations are getting to grips with the impact of climate change, far fewer are aware of nature-related dependencies, impacts and risks. There are clear interdependencies between climate and nature, and we cannot solve one crisis without tackling the other. Forests and oceans are among the most significant natural carbon sinks, acting as nature-based solutions to climate change. Similarly, climate change is a driver of nature loss. Nature and climate actions by business, policy makers and investors need to be coordinated and should be considered together across financial and economic systems.

To avoid catastrophic consequences, we need to halt and reverse nature loss by 2030. Businesses, the finance sector and regulators therefore need to transition to a nature positive economy at pace.

Why do organizations need to act now?

Global focus on nature is increasing. The landmark Kunming-Montreal Global Biodiversity Framework was agreed in December 2022 at the UN Convention on Biological Diversity (COP15), with an overall goal to “halt and reverse biodiversity loss”. The framework set ambitious targets to be achieved by 2030. One target is for signatories to ensure that all large and transnational companies and financial institutions “regularly monitor, assess and transparently disclose their risks, dependencies and impacts on biodiversity … along their operations, supply and value chains, and portfolios”.

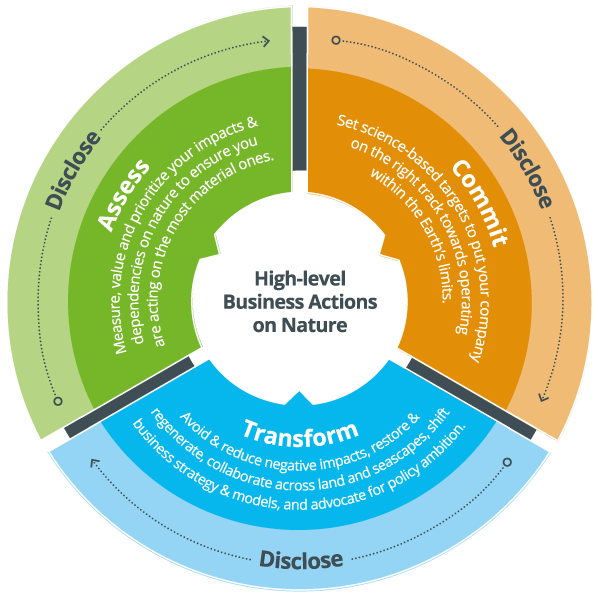

There is also a rising demand for nature-based disclosures from investors and other stakeholders. These are stakeholders who recognize the risks posed by nature loss and want to use nature-based disclosures to inform their capital allocation or lending decisions.Organizations across the world therefore need to transform their business strategies and operations. By following the actions below, organizations can contribute to a nature positive economy:

- Assess – identify, measure and value your nature-related impacts, risks and opportunities, and dependencies.

- Commit – use science-based targets and update your governance arrangements.

- Transform – improve your decision making, strategy and business models.

- Disclose – provide information to investors and wider stakeholders.

Beyond this, we must prepare not only for nature-related reporting regulations to become mandatory – as happened with climate-related disclosures – but for the consideration of material nature-related impacts and risks to become the norm.

How can accountants aid the nature positive transition?

For many organizations, increased recognition of the scale of the climate and nature challenges is driving a shift in how they think about value creation and risk management – creating a growing business need for accountants who understand sustainability and can integrate it into decision making and reporting.

Many accountants are already involved in managing and disclosing climate-related risks. This work can include scenario analysis and preparing disclosures aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, the International Sustainability Standards Board (ISSB) sustainability standards or the European Sustainability Reporting Standards (ESRS).

The logical next step is for accountants to apply their skills to nature. As professional accountants, part of our role is to help identify material risks and opportunities and provide information that can underpin informed and improved strategic and operational decision making. The scope of this role is already expanding to include a wider range of issues which could have both financial and nonfinancial impacts, including current and future nature-related risks and opportunities.3

We have the skills and competencies to support nature positive decision making, including the accurate assessment, analysis, reporting and assurance of nature-related issues. This is critical considering the material financial impact that current and future nature-related risks and opportunities may have.

Accountants can help to integrate nature-related risks, opportunities, impacts and dependencies into corporate governance, risk management, budgeting, capital allocation and investment processes, as well as internal and external reporting.

WHAT KEY INITIATIVES ARE RELEVANT TO ACCOUNTANTS?

Many nature initiatives and frameworks have been developed to help organizations understand and manage their relationship with nature. Key initiatives relevant to accountants include:

The Taskforce on Nature-related Financial Disclosures (TNFD) – the TNFD framework provides recommended disclosures for corporates and financial institutions on nature-related dependencies, impacts, risks and opportunities. The overall structure and disclosures are modelled on the TCFD recommendations to increase ease and speed of uptake and allow for integration. The framework contains detailed guidance on how to understand your relationship with nature including how to identify and assess interactions with nature using a LEAP approach (locate, evaluate, assess and prepare). A flexible approach to materiality is taken, and the recommended disclosures are compatible with the ISSB and Global Reporting Initiative (GRI) standards and aligned with the Kunming-Montreal Global Biodiversity Framework.

The EU Corporate Sustainability Reporting Directive – the directive requires all large companies and all listed companies (except listed micro-enterprises) – roughly 50,000 firms – to report on nature and biodiversity. Reporting should be in line with the European Sustainability Reporting Standards using the double materiality/impact perspective4 from the financial year 2024 onwards.

The Global Reporting Initiative – the GRI has released its updated Biodiversity Standard to reflect internationally agreed best practice. It will assist companies to disclose their most significant impacts on biodiversity and how they manage them.

Natural Capital Protocol – this framework from the Capitals Coalition is a decision-making framework that enables organizations to identify, measure and value their direct and indirect impacts and dependencies on natural capital.

Science Based Targets Network – the network helps organizations develop science-based targets for nature, including targets related to freshwater, land, oceans and biodiversity.

WHAT ACTIONS CAN ACCOUNTANTS TAKE NOW?

Organizations that understand, manage and disclose their nature-related impacts, dependencies, risks and opportunities will be both more resilient and more attractive to investors and consumers. Accountants can help drive better decision making within their organizations, improving the rigour and usefulness of nature-related information and disclosures. In turn, by helping develop material, more transparent, nature-based disclosures, accountants can contribute to the redirection of capital flows needed to support a nature positive economy.

Accountants can:

- Help to build the business case for nature-related disclosures and internal reporting by familiarizing yourself with recent key developments and how they apply to your organization.

- Develop an understanding of your material nature-related impacts, dependencies, risks and opportunities and the financial implications of these, working with others across the organization.

- Adapt governance of nature-related dependencies, impacts, risks and opportunities to ensure that appropriate policies are in place, management is involved in assessing and managing these policies, and board oversight is effective.

- Integrate nature-related considerations into management information and reporting, ensuring that underlying data is robust, comparable and reliable so it can be trusted by decision makers.

- Integrate nature-related considerations into financial processes, including budgeting, capital allocation, investment decision making, risk and compliance processes, and stakeholder relations.

- Enhance any nature-related targets by making sure that they are supported by reliable data and streamlining data collection and verification methods.

- Contribute to scenario analysis that reflects the potential outcomes of transitioning to a nature positive economy in the face of complex uncertainties.

- Learn from your experience with climate-related risk management and financial disclosures, and see where you can leverage the processes and insights gained.

- Collaborate with others in your value chain and sector to increase your ambition and effectiveness. Engage with data users, particularly investors, to understand their needs for effective responses to nature-related risks and opportunities.

USEFUL DEFINITIONS

Nature – the natural world, with an emphasis on the diversity of living organisms (including people) and their interactions among themselves and with their environment.5

Nature positive – an evolving term typically used to refer to the global aim to halt and reverse nature loss by 2030 (with a 2020 baseline) with a view to full recovery by 2050. Achieving a nature positive target for an individual organization is highly complex and would require a whole value chain approach. Organizations are therefore encouraged to work towards a nature positive economy.

Biodiversity – the diversity of all living things, and a subset of nature. A high level of biodiversity boosts the productivity of ecosystems and therefore increases natural capital. Importantly, it also increases the resilience of an ecosystem to climate change.

Natural capital – the stock of renewable and non-renewable natural resources (eg, plants, animals, air, water, soils, minerals) that combine to yield a flow of benefits to people.6

Ecosystem – a community or group of living organisms that live in, and interact with each other in, a specific environment,7 a tropical forest. To note, “ecosystem services” are the benefits to people from ecosystems, such as timber, genetic resources ('provisioning services'), pollination, water regulation, climate regulation ('regulating and maintenance services'), and recreation and mental health ('cultural services') and soil formation (‘supporting services’).8

References

- World Economic Forum, New Nature Economy Report Series

- World Economic Forum, Global Risks Report 2024

- A4S Accounting Bodies Network, Transforming the Profession: The future of accountancy

- Accounting for Sustainability (A4S), Unlocking materiality as a source of value creation

- Díaz, S et al (2015), ‘Glossary – TNFD’,

- Capitals Coalition, Natural Capital Protocol

- youmatter, Ecosystem: Definition, Examples, Importance – All About Ecosystems

- Millennium Ecosystem Assessment, Millennium Assessment Reports